Commercial Feature

Decoding Your Paycheck: The Graduate’s Guide to What You Actually Earn

You’ve done it. The offer is in your hand. Let’s say it’s for £30,000. It’s a milestone. You immediately start doing the maths in your head £2,500 a month! Plans start forming. A nicer flat. A proper holiday. Finally moving out of the student house with the mouldy shower.

Time for a reality check. That £30,000 is a mirage. The number that will actually fund your new life your take-home pay UK is a different figure entirely, and it can be a shock if you’re not prepared. For graduates stepping into their first salaried role, the gap between gross salary and net income is the single most important piece of financial literacy you won’t have been taught in a lecture hall.

Why Your Gross Salary is a Fantasy Figure

Your employer agrees to pay you £30,000. This is your gross salary. But before that money ever touches your bank account, three key deductions happen automatically:

- Income Tax: You have a tax-free Personal Allowance (£12,570), then you pay 20% on earnings above that.

- National Insurance (NI): Another mandatory contribution, calculated weekly or monthly on earnings above a lower threshold.

- Student Loan Repayments (Plan 2/Plan 5): If you have a loan, repayments kick in at 9% of earnings above £27,295 (Plan 2) or £25,000 (Plan 5).

Suddenly, your £2,500 gross monthly dream is more like £1,900 – £2,000 in reality. That’s a £500-£600 difference the difference between being comfortable and being constantly stressed about money. You cannot budget with the gross figure.

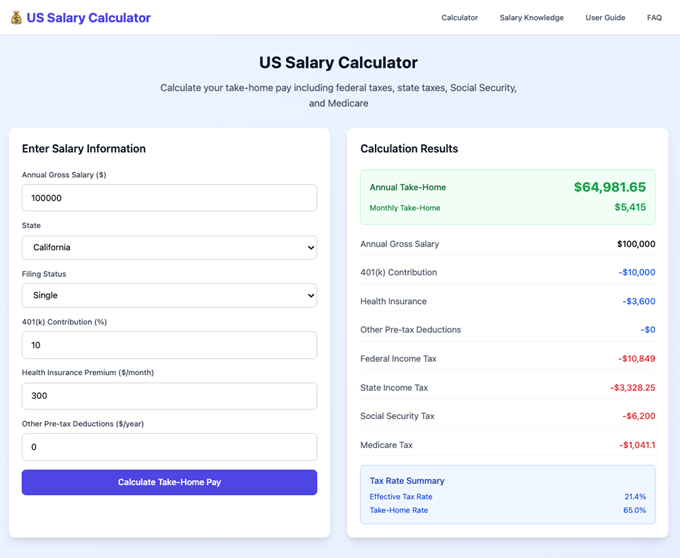

This is where you need to stop estimating and start calculating. A precise payroll calculator UK is your essential tool. It’s not just for accountants; it’s for you. Input your salary, your student loan plan, and your pension choices, and it will instantly show your exact net monthly or weekly pay, with a clear breakdown of every single deduction. It turns a hopeful guess into a financial fact.

From Panic to Plan: How This Knowledge Changes Everything

Understanding your true net income isn’t just about avoiding a nasty surprise. It’s the foundation for every smart decision you’ll make next.

- Budget with Confidence, Not Hope: With your real take-home figure, you can finally build an adult budget that works. You can look at actual rent prices, factor in bills, transportation, and groceries, and know exactly what’s left for savings or socialising. This prevents the classic “mid-month money panic” so many new graduates face.

- Evaluate Job Offers on a Level Playing Field: Is a £32,000 offer in London better than a £28,000 offer in Manchester? The only way to know is to calculate the net pay for each and then compare it against the radically different cost of living. A calculator lets you run these comparisons in minutes, ensuring you make a geographic choice based on real spending power, not just a bigger headline number.

- Ask Smarter Questions About Your Package: When you understand deductions, you can have an informed conversation about your payslip. You can ask HR about salary sacrifice schemes for pensions or cycle-to-work schemes, which can legally increase your take-home pay by reducing your gross salary before tax.

Your First Professional Skill: Financial Self-Advocacy

University taught you to research, analyse, and verify information. Apply that skill to your own life first. Your job offer and first payslip are primary sources that need interrogating.

Using a salary calculator isn’t being paranoid; it’s being professional. It’s taking control of your financial entry into the working world. It moves you from being a passive recipient of a paycheck to an active manager of your own finances.

So, before you sign that contract, before you start browsing Rightmove, and definitely before you commit to any direct debits, do the one thing that will set you up for success: know your number. Not the one your future employer promises, but the one you’ll actually get to live on. It’s the most responsible first step you can take into your new life.

News / Colleges charge different rents for the same Castle Street accommodation2 March 2026

News / Colleges charge different rents for the same Castle Street accommodation2 March 2026 News / King’s hosts open iftar for Ramadan3 March 2026

News / King’s hosts open iftar for Ramadan3 March 2026 Theatre / Lunatics and leisure centres 4 March 2026

Theatre / Lunatics and leisure centres 4 March 2026 News / Angela Merkel among Cambridge honorary degree nominees27 February 2026

News / Angela Merkel among Cambridge honorary degree nominees27 February 2026 News / News in Brief: waterworks, wine woes, and workplace wins 1 March 2026

News / News in Brief: waterworks, wine woes, and workplace wins 1 March 2026