Nearly half of Cambridge investment office staff resign

The University’s Investment Office has faced criticism in recent months for its approach to investing Cambridge’s endowment

Four senior members of Cambridge’s investment office have resigned from their positions, out of a staff of nine.

Chief Investment Officer Nick Cavalla will leave the investment office later this year, alongside colleagues Bruce Lockwood, Conor Cassidy and Vincent Fruchard.

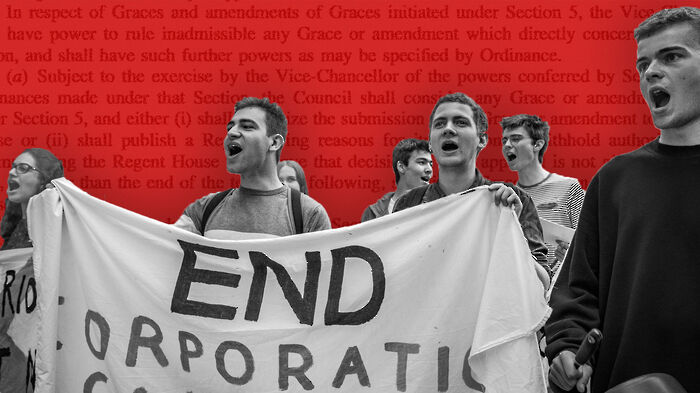

Their resignations come four months after a divestment working group report called for the office’s practices to be made more transparent at the tail end of mounting pressure from staff and student activists for the University to divest its endowment from fossil fuels.

The Financial Times reported two people familiar with Cavalla’s resignation said he believed the debate around divestment has left staff unable to get on with their “jobs of trying to maximise the value of their endowment”.

Want to join Varsity's news team?

Try your hand at student journalism. Applications are now open for Varsity Senior News Correspondents in Michaelmas term

The four senior members oversaw the university endowment fund's main investment pot worth £3.3bn.

Cambridge’s investment office manages its investments and £6.3bn endowment – the centre of the divestment debate. The University currently holds no direct investments in the fossil fuels sector’s most pollutive industries, and has a policy of keeping its indirect investments in tar sands and thermal coal industries “to the bare minimum.”

Pro-divestment campaigning group Cambridge Zero Carbon Society had previously called for Cavalla’s resignation after the Council’s divestment decision in June, saying in a statement: “We call on the University’s Chief Financial Officer Anthony Odgers, Chief Investment Officer Nick Cavalla and Director of Finance David Hughes, hired from Shell, to resign.”

Speaking on Cavalla’s resignation, Vice-chancellor Stephen Toope said: “He has transformed the performance of our investment fund, enabling us to diversify our income in a way that has allowed the University to undertake developments which have greatly benefited our academic mission and our students”.

Mia Watanabe, a spokesperson for Cambridge Zero Carbon Society, commented on the four resignations of Investment Office staff: “Now is the time to build an open, transparent Investment Office, an office led by the concerns of staff and students and fully divested from fossil fuels”, adding that the plan “to reject divestment [...] carries no legitimacy”.

In late July, two formal requests for a review of the Council decision were submitted – one by Cambridge Zero Carbon Society, and the other by a group of academics. They await a response within three months of submission.

The four senior members are set to join Talisman Global Asset Management, the investment arm for the Pears family – one of the wealthiest families in the UK.

Cavalla said that it “felt like the right time to take on a new challenge” away from the University, after joining in 2008.

News / Judge Business School advisor resigns over Epstein and Andrew links18 February 2026

News / Judge Business School advisor resigns over Epstein and Andrew links18 February 2026 News / Hundreds of Cambridge academics demand vote on fate of vet course20 February 2026

News / Hundreds of Cambridge academics demand vote on fate of vet course20 February 2026 News / Gov grants £36m to Cambridge supercomputer17 February 2026

News / Gov grants £36m to Cambridge supercomputer17 February 2026 News / CUCA members attend Reform rally in London20 February 2026

News / CUCA members attend Reform rally in London20 February 2026 News / Union speakers condemn ‘hateful’ Katie Hopkins speech14 February 2026

News / Union speakers condemn ‘hateful’ Katie Hopkins speech14 February 2026