Wealth doesn’t ‘trickle down’ – even in theory

Are the majority still holding out their empty glasses? India Stronach critiques trickle-down economics as a simplistic theory that fails to manifest itself in practice

The phrase ‘the rising tide lifts all boats’ was brought to prominence by John F. Kennedy in a 1963 speech as a simple defence against accusations of favouritism. Although given to him by speechwriter Ted Sorensen, JFK kept using the phrase until it became the emblematic aphorism of the American free-market. Conservative politicians, particularly in the USA but across the world as well, continue to profess its truth, contrary to most - if not all - evidence. Critics are far more likely to turn to the alternative term ‘trickle-down economics’, with much less of JFK’s comforting wisdom.

The policy of lowering taxes to create economic growth through higher spending exists in two subsets of economic theory. In supply-side, taxes are lowered overall. In trickle-down, taxes on the rich are targeted on the assumption that their increased spending will boost the economy. Most studies unfortunately correlate cuts to the top 1% in taxes to increases in income disparity—perhaps because this brief summation on the concept is about as far as it was thought out, in its very appearance.

“The term ‘trickle-down economics’ was coined as a joke”

The term ‘trickle-down economics’ was coined as a joke. A 1932 column by humorist Will Rogers, published in an America shadowed by the Depression, described how Republican politicians attempted to appeal to the working class by claiming that wealth trickled from the top sections of society down to lower levels through spending, like a wine glass overflowing into those beneath it. Rogers, like most, refuted the model. Instead, he described how wealth ‘trickles’ up—the earnings of the poor mysteriously vanishing into the hands of the rich, big banks bailed out by the government, while the little ones crumple. His description involved the simplest model of water flowing down a hill, and mysteriously floating back up. Later variations brought in more appealing, flamboyant imagery as the idea moved from satire into policy. The economic model now conjures the images of shining fountains and flowing cascades of wine—every decadent frame of the roaring twenties.

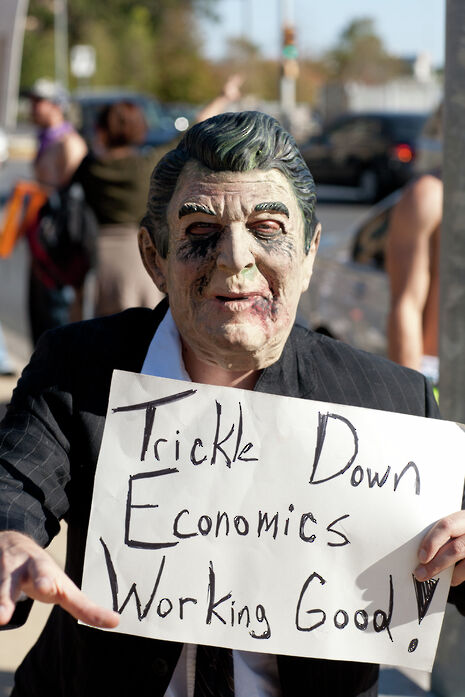

The transition from Chicago theory to politics really took root with Ronald Reagan’s economics. The policies were adapted almost simultaneously into Margaret Thatcher’s budgets. Reagan’s budget director, David Stockman, admitted that borrowing the phrase from critics of “Reaganomics” was a response to the unpopularity of supply-side tax reductions. For all that it was quickly disowned by Stockman, this was turned into criticisms of the administration, accusations of caring only about the rich. And it is not a pure party-line split—anti-trickle-down politics have emerged in the UK left wing recently for the first time since the advent of New Labour, who used them to expand their appeal to the ever-shifting perception of “middle England.” In the USA, trickle-down has fallen out of satire too, used by both parties as recently as Obama’s budgets in 2012, criticised only when taken to its absolute extreme—an accusation levelled at Donald Trump during his campaign by Hilary Clinton, also a proponent of trickle-down theory.

“Whether the theory works or not is immaterial to those who debate it”

The theory of trickle-down economics stems ultimately from the horse-and-sparrow theory of the 1890s. Horse-and-sparrow theory was perhaps more honest; it espoused that if the horses were fed enough oats, then eventually there would be some left for the sparrows to peck. Here we see the truth of trickle-down taxes. The wine glass on top fills, and fills, and fills, and only when the rich have had their absolute fill- so much that they can’t take another drop, do the poor get a splash of success—even in theory.

This is theory. When reality sets in, this is talking about money: not fountains, not wine, not sparrows. People’s purses have significantly fewer limits than their appetites. There is no point where you simply cannot have any more money and must reluctantly shed some of it off to the nearest small business. There is nothing stopping the rich from accepting the tax cut, getting richer, and richer, filling the wine glass as it swells and swells and the empty glasses under it buckle and shatter under the pressure.

Trickle-down, really, has never been believed in. It has, always and only, been a phrase used to convince the masses that favours to the rich are for their benefit too. And yet people defend it virulently. People strive against it virulently too.

The flaw is not in the theory: whether the theory works or not is immaterial to those who debate it. Its proponents use trickle-down economics either in the belief that it works, without evidence or case studies, or in the belief that will keep people quiet. The flaw is in the way we talk about economics, almost purely in these metaphors of wine, or oats, or flowing fountains. I’m guilty of it myself. The metaphors are good at making big, complicated models easier to understand—but that’s about all they’re good for. Where they fall short is in conveying that these theories are discussing a resource which people can hoard infinitely—a resource without which human lives are at risk

News / Reform candidate retracts claim of being Cambridge alum 26 January 2026

News / Reform candidate retracts claim of being Cambridge alum 26 January 2026 Interviews / Lord Leggatt on becoming a Supreme Court Justice21 January 2026

Interviews / Lord Leggatt on becoming a Supreme Court Justice21 January 2026 News / Report suggests Cambridge the hardest place to get a first in the country23 January 2026

News / Report suggests Cambridge the hardest place to get a first in the country23 January 2026 Comment / How Cambridge Made Me Lose My Faith26 January 2026

Comment / How Cambridge Made Me Lose My Faith26 January 2026 Features / Are you more yourself at Cambridge or away from it? 27 January 2026

Features / Are you more yourself at Cambridge or away from it? 27 January 2026